How to Retire Confidently — Even If 2025 Is a Disaster

Join this 30-minute, hard-hitting live session to discover how to protect your money, your income, and your future—no matter what 2025 throws at you.

How to Retire Confidently — Even If 2025 Is a Disaster

Join this 30-minute, hard-hitting live session to discover how to protect your money, your income, and your future—no matter what 2025 throws at you.

Submit the form below to secure your spot!

The Economy Looks Uncertain — But Our Clients Aren’t Worried. Learn Why in This Free Webinar.

Join This 30-Minute, Hard-Hitting Live Session — Learn How To Build A Retirement Plan That Holds Up No Matter What.

Play Video for a Special Message

Submit the form below to secure your spot!

The Economy Looks Uncertain — But Our Clients Aren’t Worried. Learn Why in This Free Webinar.

"IS 2025 THE NEXT RECESSION?"

What the Data Shows - and How to Protect Your Money Before It's Too Late.

Warning Signs

Are Everywhere

The Economic Storm May Already Be Forming

Interest rates are still elevated — and may rise again.

Consumer and federal debt have both hit record highs.

Trade tensions, tariffs, and falling business investment threatens growth.

Why It Matters

to You

If the Economy Slows, Your Finances Could Too

Everyday expenses could take a bigger bite out of your budget.

Market losses could derail your retirement plan.

Without the right strategy, you may need to delay retirement — or worse, return to work to keep up.

What You Can

Do About It

Build a Protection Strategy Before It's Too Late

Learn how to limit downside risk when markets fall.

Discover how to share in the market’s upside during growth years.

Gain peace of mind with a retirement framework that works automatically — no matter what happens next.

You Only Get One Shot at Retirement —

Here’s How Fast It Can Go Wrong

You Only Get One Shot at Retirement — Here’s How Fast It Can Go Wrong

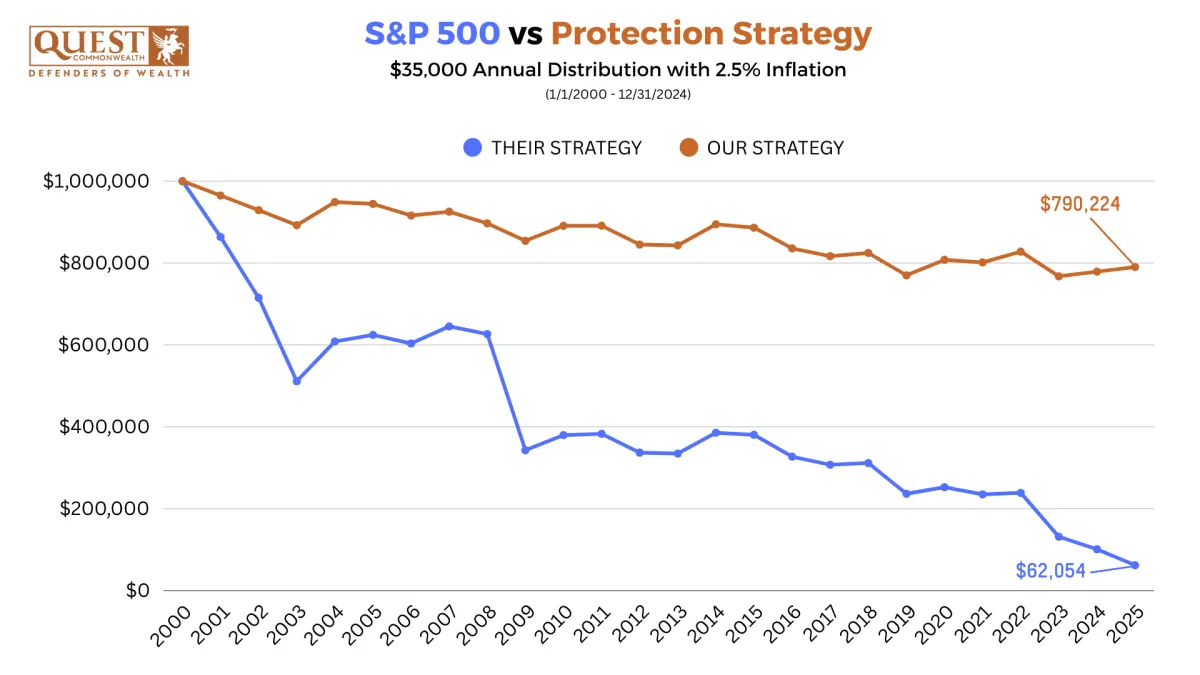

This chart shows two retirees who both started retirement in the year 2000 — each with $1 million saved. They both withdrew $35,000 per year, adjusted annually for 2.5% inflation.

The Blue Line followed a traditional growth strategy, staying fully invested in the S&P 500 and riding the ups and downs of the market.

The Orange Line followed a preservation-first strategy designed to protect against major losses while still supporting steady income.

Even though their starting points and withdrawal amounts were exactly the same, their outcomes couldn’t be more different.

Just one bad year — especially early on — can drain decades of savings. Without the right strategy, a single recession could derail your entire retirement.

Don't Let Market Timing Decide Your Retirement Outcome!

Real People. Real Results. Real Peace of Mind.

Here Are Just a Few of the Clients We've Helped Along the Way.

"Checks all the right boxes."

"Detailed financial analysis."

"Has a way of making you feel at ease."

"We will always recommend them."

"Been with them more than 20 years."

"Knowledgeable, caring, accessible."

These clients took the first step. Now it's your turn.

These clients took the first step. Now it's your turn.

Copyright © 2025 – Quest Commonwealth - All Rights Reserved

Copyright © 2025 - Safe Money Mindset™ - All Rights Reserved

Investment advisory services offered through Foundations Investment Advisors, LLC (“Foundations”), an SEC registered investment adviser. Nothing on this website constitutes investment, legal or tax advice, nor that any performance data or any recommendation that any particular security, portfolio of securities, transaction, investment or planning strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Foundations, execution of required documentation, and receipt of required disclosures. Investments in securities involve the risk of loss. Any past performance is no guarantee of future results. Advisory services are only offered to clients or prospective clients where Foundations and its advisors are properly licensed or exempted. For more information, please go to https://adviserinfo.sec.gov and search by our firm name or by our CRD #175083.

Any comments regarding safe and secure investments and guaranteed income streams refer only to fixed insurance products. They do not in any way refer to investment advisory products. Rates and guarantees provided by insurance products and annuities are subject to the financial strength of the issuing insurance company; not guaranteed by any bank or the FDIC.

All reviews or tesitimonials are unpaid and given freely by actual clients of Quest Commonwealth. A client testimonial does not guarantee future investment success and should not be indicative that any client or prospective client will experience the same or a higher level of investment performance.